20+ Beta Coefficients Are Generally Calculated Using Historical Data.

Beta is calculated using historical data points making it less meaningful for investors looking to predict a stocks future movements. Beta Covariance r s r m Variance r m Where r s Return on Security.

Global Estimates And Long Term Trends Of Fine Particulate Matter Concentrations 1998 2018 Environmental Science Technology

Based on your understanding of.

. β 1 more volatile than the market. Formula Beta coefficient is calculated by dividing the covariance of a stocks return with market. Web SEC Form N-6F.

Web Method 1 How to calculate beta in Excel using slope On the same worksheet as the data data must be on the same page as the formula type slopex data y data The X data. β 1 exactly as volatile as the market. Mean is the average.

Web Financial institutions often depict a single number for Beta on their sites. About the Calculator Features. The SP500 is a common choice or the Russell 1000 for smaller stocks or a foreign or global.

R m Market Return. What index to use. A filing with the Securities and Exchange Commission SEC that must be submitted by a company intending to file a notification of election to be.

β 0 less volatile than the market. Web To calculate a historical Beta you need to make some choices. Web SOLVEDBeta coefficients are generally calculated using historical data.

True Stock As beta is 10. Steps to Calculate the Coefficient of Variation. Here is an example on how the coefficients are calculated using iterative methods.

The preceding data series represents a sample of falcons historical returns. Higher-beta stocks are expected to have higher required rates of returns. Web The beta coefficient can be interpreted as follows.

Calculate the mean of the data set. Web Formula For the Coefficient of Variation is given by. Web In finance the beta of a firm refers to the sensitivity of its share price with respect to an index or benchmark.

Web How to Calculate the Beta Coefficient. Beta is not futuristic. An average stock is said to have a beta of 10.

Web There is no single answer here as beta is just a statistics. Web As mentioned by fcop there is no formula analytical solution for the beta. Generally the index of 10 is selected for the market.

Web Analysts generally use historical data to calculate the beta and use it as an estimate of the stocks volatility relative to the market. VIDEO ANSWERFor this problem we are asked to to determine if the following. Web Beta coefficient is the slope of the security market line.

Web The formula of beta is as follows. Beta in corporate finance can be. To calculate the Beta of a stock or portfolio divide the covariance of the excess asset returns and excess market returns by.

Web Beta coefficients are generally calculated using historical data. Web Beta coefficients are generally calculated using historical data. Web Beta coefficients are generally calculated using historical data Overvaluation If the required rate of return is less than the expected rate of return High-beta stocks are most.

True Higher-beta stocks are expected to have higher required returns. Statement True False Beta coefficients are generally. Web Beta coefficient β covariance r e r m variance r m where.

Do not let the qualitative-finance world tell you what beta is or isnt. Web Based on your understanding of the beta coefficient indicate whether each statement in the following table is true or false. True or False 3.

To get that same long-term Beta value use 5 years of monthly bars for quotes and a value of 60 for. Web It can be measured by a metric called the beta coefficient which calculates the degree to which a stock moves with the movements in the market.

Statistical Data Analysis For Trackway Asset Management Using Low Level Nonconformance Rates Journal Of Infrastructure Systems Vol 29 No 1

Statistical Data Analysis For Trackway Asset Management Using Low Level Nonconformance Rates Journal Of Infrastructure Systems Vol 29 No 1

Implications For Climate Models Of Their Disagreement With Observations Climate Etc

Color Online Calculated Sodium Void Coefficient Svr For The Download Scientific Diagram

In Credit Risk What Is The Formula To Calculate The Long Run Probability Of Default Quora

Pdf Reexamination Of Estimating Beta Coefficient As A Risk Measure In Capm

Assessing The Impact Of Sars Cov 2 Prevention Measures In Austrian Schools By Means Of Agent Based Simulations Calibrated To Cluster Tracing Data Medrxiv

Public And Private Equity Returns Different Or Same The Journal Of Portfolio Management

Catalyst Sintering Kinetics Data Is There A Minimal Chemical Mechanism Underlying Kinetics Previously Fit By Empirical Power Law Expressions And If So What Are Its Implications Industrial Engineering Chemistry Research

Full Article 17th Annual Aacn Conference And Workshops Of The American Academy Of Clinical Neuropsychology Aacn At The Chicago Marriott Downtown Magnificent Mile 540 North Michigan Avenue Chicago Illinois 60611 June 5 8 2019

Usda Open Data Catalog Usda

Spatial Autocorrelation Of Ecological Phenomena Trends In Ecology Evolution

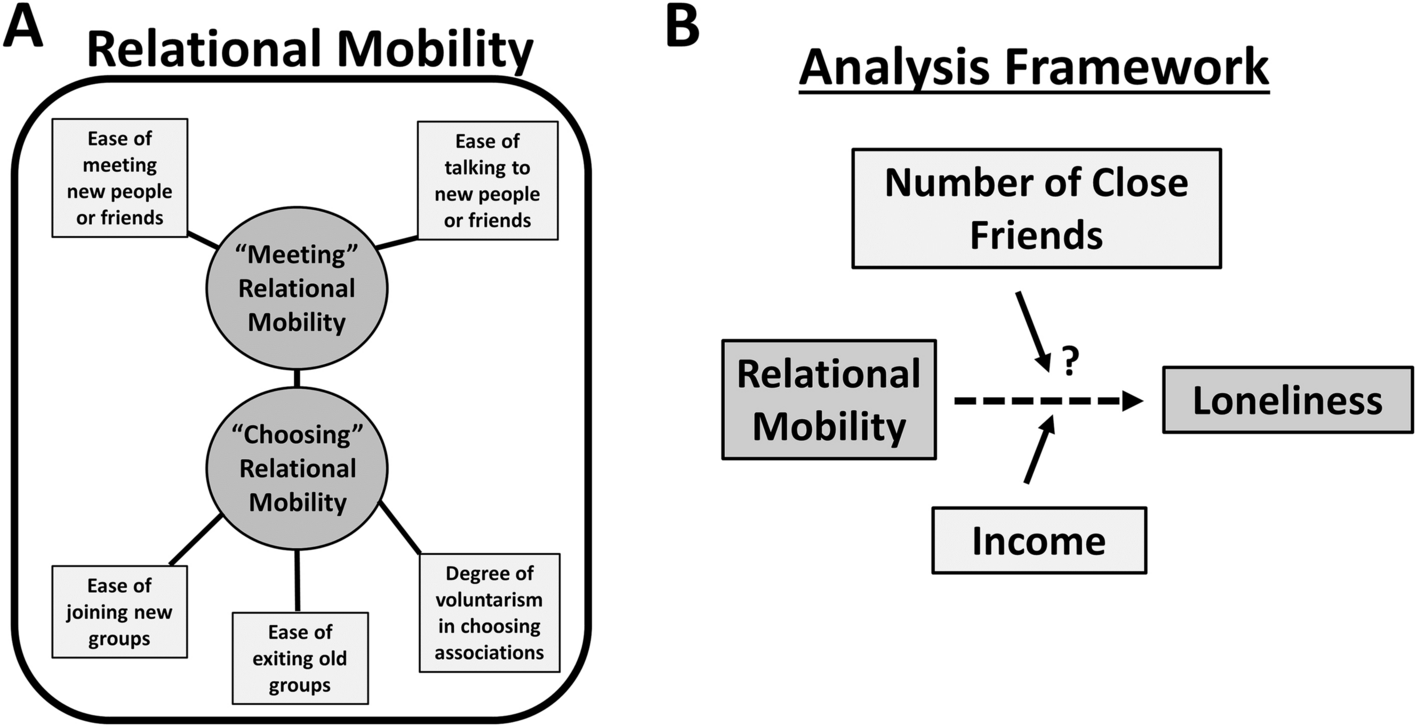

Perceptions Of Social Rigidity Predict Loneliness Across The Japanese Population Scientific Reports

20 Years Of Progress In Radar Altimetry Symposium

What Is The Difference Between Standard Deviation And Beta Quora

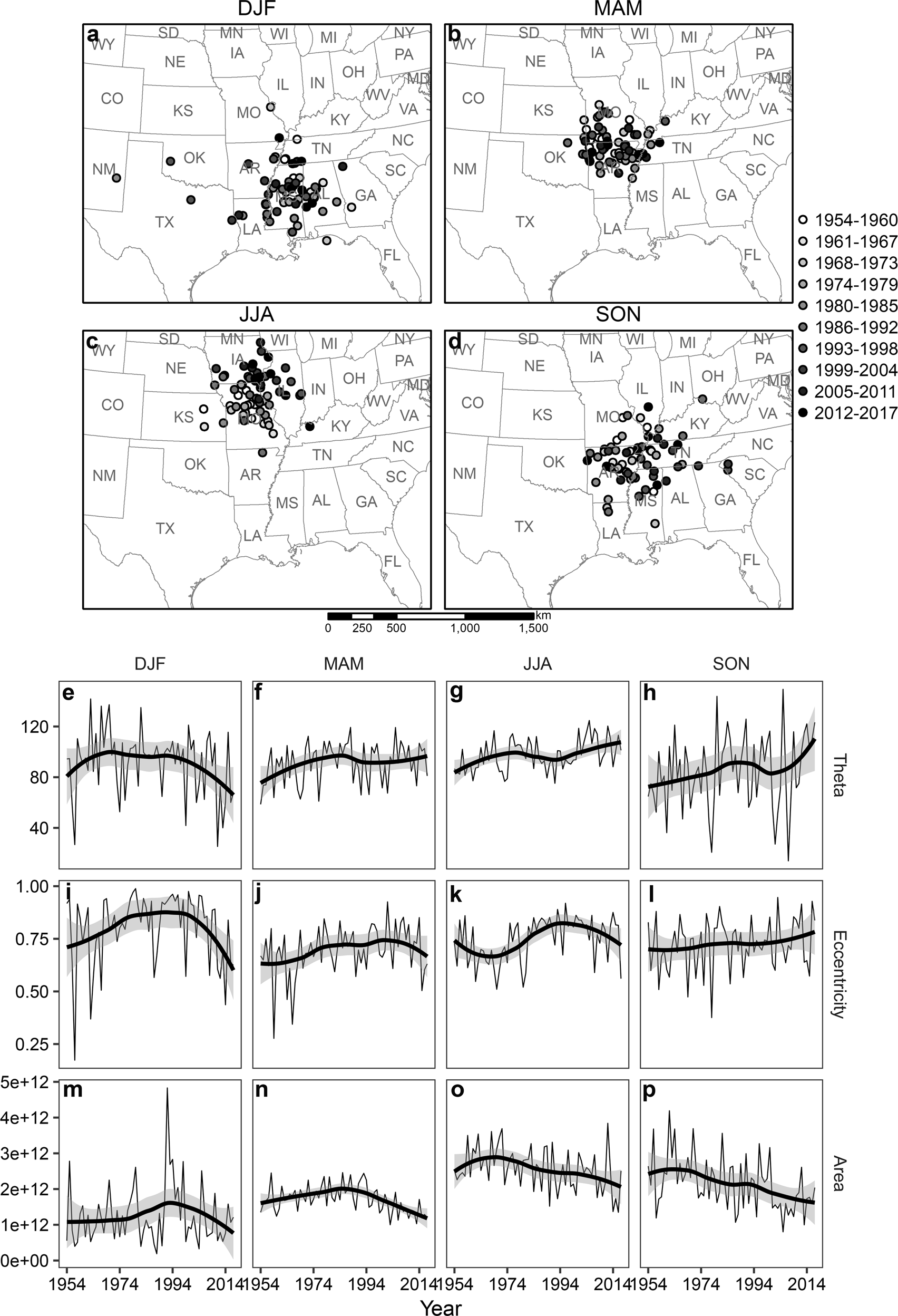

Using The Standard Deviational Ellipse To Document Changes To The Spatial Dispersion Of Seasonal Tornado Activity In The United States Npj Climate And Atmospheric Science

Wildfire Combustion And Carbon Stocks In The Southern Canadian Boreal Forest Implications For A Warming World Dieleman 2020 Global Change Biology Wiley Online Library